We will partner with your investment advisor and provide information to help evaluate the most tax-advantageous retirement plan options and tax implications of investment strategies. Reviews provide limited assurance to outside interests and involve inquiries and analytical procedures that confirm financial statement matters and identify any items requiring further analysis. Your bookkeeping https://blackstarnews.com/detailed-guide-for-the-importance-of-construction-bookkeeping-for-streamlining-business-operations/ team consists of 3 professionally trained bookkeepers, including one senior bookkeeper who reviews all of your monthly statements and your Year End Financial package.

Plan for Growth and Expansion:

Say goodbye to piles of paperwork and time-consuming manual tracking—we automate inputs directly from linked accounts. Get insights from one central dashboard so you can easily understand the health of your business and make strategic decisions. Our team of pros is familiar with Arizona tax rules and will customize their approach to your business’ unique needs. Our team is ready to learn about your business and guide you to the right solution.

- As a small team of dedicated professionals, our commitment to excellence and attention to detail ensure that your financial records are accurate, up-to-date, and in compliance with industry standards.

- Cash flow is the lifeblood of any business, and general contractors must monitor it closely.

- There are some times that we’ll request documents from you (like account statements or receipts), just to ensure the information we have is correct.

- What sets us apart from any builder and general contractor in Tucson, is our personal attention to each project.

Bookkeeping & Tax

Gnesist is an accounting firm helping Tucson residents and businesses minimize liabilities and achieve regulatory compliance. It provides bookkeeping services, including invoice creation, processing, and tracking, additionally calculating employee wages, deductions, and benefits. Its experts also prepare, review, and file state and federal income taxes, utilizing financial management tools such as QuickBooks, Xero, and Gusto.

Frequently Asked Questions

You’ll always have the human support you need, and a mobile friendly platform to access your up-to-date financials. Following in the footsteps of her dad and uncle, Kirsten has set out to provide residential and commercial construction services with an unmatched level of attention to detail. Kirsten takes pride in being responsive, providing cost-effective solutions and staying client-focused. Cornerstone Construction is a full-service general contractor in Tucson, AZ that delivers the highest quality services for residential and commercial clients. As a family-owned and operated business, we are able to provide the hands-on attention to detail, customer focus and high quality that has become our hallmark with all our client projects.

Simple, straightforward pricing for everything your business needs.

Managing finances effectively is crucial for general contractors to ensure business success and long-term stability. Construction accounting requires careful attention to detail, as the industry’s unique nature demands accurate tracking of expenses, cash flow, and taxes. By implementing strong construction bookkeeping services, contractors can gain clear insight into their financial position, make informed decisions, and avoid common pitfalls that may The Significance of Construction Bookkeeping for Streamlining Projects hinder business growth.

The owner of Maureen Erhardt, CPA has more than 30 years of professional experience and strives to give each customer the highest level of personalized service. The company’s website offers free financial and tax advice, and first-time customers can call the company to schedule a free initial consultation. Taxes can be a significant burden for contractors if not managed properly. Allocating a portion of your income specifically for taxes helps avoid unexpected liabilities during tax season.

- Available services include income tax preparation, customized small business bookkeeping, and forensic accounting to detect fraud and other issues.

- If there’s any change in your bookkeeping team, we’ll let you know as soon as possible and make sure the transition is a smooth one.

- The friendly professionals at Arizona Small Business Accounting have been serving individuals, businesses, and nonprofits for more than 30 years.

- In any case, your company’s leadership deserves a comprehensive approach that our professionals can provide.

- Financial and personal records are often vast and confusing to sort through.

We use Plaid, which lets you securely connect your financial accounts to Bench in seconds. This feature saves you the time and effort of manually uploading documents. We scored Tucson Bookkeeping Services on more than 25 variables across five categories, and analyzed the results to give you a hand-picked list of the best. I’ve worked on the General Contracting side and the Subcontracting side and have loved both.

Services you can count on

Alan C Sears, CPA have been serving Tucson customers since 1979, using years of professional experience to provide personalized services to individuals, families, businesses, fiduciaries, and nonprofits. Available services include local, state, and federal tax preparation, general bookkeeping, and expert QuickBooks set-up. The accountant helps business owners manage payroll and daily accounting, as well as providing up-to-date advice to streamline financial practices.

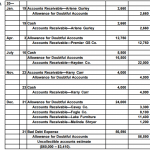

Undeposited funds in QuickBooks Online can cause confusion and inaccuracies in your financial records if not properly managed. In this comprehensive guide, we’ll walk you through the process of cleaning up undeposited funds in QuickBooks Online, as well as how to clear, fix, get rid of, and delete undeposited funds. We’ll also cover how to clear undeposited funds in QuickBooks Desktop and how to turn off undeposited funds in QuickBooks Online.

- This account is created automatically as part of your business’s chart of accounts and cannot be deleted.

- This process involves cross-referencing bank statements, invoices, and receipts to identify any discrepancies or missing transactions.

- See our overall favorites, or choose a specific type of software to find the best options for you.

- Why not set up QBO to make deposits directly into the bank account as a default?

It helps to reconcile any inconsistencies and prevent errors in financial reporting. Take your time to verify the details before finalizing the clearing of undeposited funds to maintain posting in accounting — definition and meaning the integrity of your accounting records. As you can see above, my reconcile screen shows one deposit for those three payments and makes it easy for me to match with my bank.

QuickBooks for Small Business: Which Version Do You Need?

That $850,000 retainer was marked in the books both against the retainer and against undeposited funds. The result was that the undeposited funds made its way onto the balance sheet as a part of their cash assets. Tax time came along, and because of a bookkeeping error, the total revenue of the business was inflated by $850,000! Therefore, this simple error required the business to pay taxes on $850,000 of additional income that had never been received. When that bulk deposit drops into your QBO bank feed, it is your responsibility to match the portion of the money to the right client’s outstanding payment due. To confuse matters more, some payment methods, like ACH or credit card, may have already subtracted a fee from the gross sum collected on behalf of the processor.

How to Delete Undeposited Funds in QuickBooks?

This not only promotes transparency and accountability but also aids in accurate cash flow management and budgeting. If you follow the technical financial accounting you will see the end result is that Income or Sales has been credited and Cash or Checking has been debited. Both accounts receivable and undeposited funds accounts were used but came out with a $0.00 balance in the end. If this process is not handled correctly you run the risk of overstating income.

Utilizing the ‘Find & Match’ feature and reconciling accounts can also aid in identifying and rectifying any redundant transactions. The undeposited funds account is like a cash box, or how to calculate your daily apr on a credit card storage bin, for your business. Many companies have a credit card processor that dumps all the day’s deposits, less processing fees, into your bank account as one lump sum. If your business falls into that category, you’ll need to use the undeposited funds asset account to unravel it all.

How to Clear Undeposited Funds in QuickBooks Desktop?

For example, let’s say Willie’s Widgets paid you $300, Wally’s Whatsits paid you $750 and Whitley’s Whosits paid you $200. However, you need to properly credit each customer for their payment. Posting each payment to the Undeposited Funds account and then recording the deposit in QuickBooks Online allows you what are the total number of psus in india to do this.

It’s crucial to maintain consistency in updating and clearing undeposited funds to avoid discrepancies and errors in financial reporting, thereby upholding the integrity of the accounting system. You will see Undeposited Funds as the default «Deposit to» account when you receive payments from invoices, use a payment item on an invoice, or enter a sales receipt. First, reconcile your bank accounts to make sure you have recorded all the deposits you have made. Once you have determined all deposits have been recorded properly, open the Bank Deposit screen again and review what is in the Undeposited Funds account.

Let’s look closer at what the Undeposited Funds Account in QuickBooks is. When business is thriving, bookkeeping has a way of sneaking up on you. It also aids in maintaining an organized and up-to-date accounting system, which is essential for making informed business decisions and meeting regulatory requirements.

Your resource for helpful tax tips, tools, and articles on how to get the most out of being self‑employed. Free accounting tools and templates to help speed up and simplify workflows. Planning for cash flow problems can empower you to cushion—or even avoid—financial blows to your business. The foundation of financial health for every business owner is separating the finances of the business from their personal finances. Starting your entrepreneurship journey and learning how to run a business requires passion, strategy, and boldness.

Get matched with a dedicated expert who will do your self-employment taxes for you, start to finish.

Each of our subscription plans include access to online help articles and customer support, when needed. Track mileage, send invoices, connect accounts, do your taxes, and much more—all with Solopreneur. Yes, you can find guidance on how to connect your bank and credit card accounts to QuickBooks Online here.

Tax & Accounting

Easily track business expenses year-around to make sure you never miss a tax quickbooks self employed login deduction. Find help articles, video tutorials, and connect with other businesses in our online community. Security Certification of the TurboTax Online application has been performed by C-Level Security. If you’re self-employed and you use your cellphone for business, you can claim the business use of your phone as a tax deduction.

- It’s also a good idea to ensure your books are reconciled — learn more about how to reconcile your books here.

- Your resource for helpful tax tips, tools, and articles on how to get the most out of being self‑employed.

- It is intended for one-person businesses looking to organize and grow their business.

- Free accounting tools and templates to help speed up and simplify workflows.

What‘s new in QuickBooks Online

It’s also a good idea to ensure your books are reconciled — learn more about how to reconcile your books here. We offer free one-on-one audit guidance year-round from our experienced and knowledgeable tax staff. Bookstime We’ll let you know what to expect and how to prepare in the unlikely event you receive an audit letter from the IRS. Self-employment tax is an amount of money paid on self-employment net income to cover a person’s Medicare and Social Security tax. Whether our experts prepare your tax return or you do it yourself, we guarantee our calculations are always 100% accurate, or we’ll pay any penalties.

Attend a free live event to learn how QuickBooks can bookkeeping help you streamline your practice and more. Optimise your business to business inventory management with Erplain. Create and send professional-looking invoices in seconds.

- Stability, investing in yourself, and running your business takes a combination of apps, knowledge, and grit.

- Photographs © 2018 Jeremy Bittermann Photography.

- Business and personal expenses are automatically sorted into categories, so you can track your spending and maximize tax deductions.

- Attend a free live event to learn how QuickBooks can help you streamline your practice and more.

- Each of our subscription plans include access to online help articles and customer support, when needed.

Uncover industry-specific deductions and get a final review by an expert before you file.

Learn how to add and manage customers in QuickBooks Online using this detailed guide. Use this walkthrough guide to learn how to complete each of these steps. Photographs © 2018 Jeremy Bittermann Photography. By accessing and using this page you agree to the terms and conditions.

- To get paid faster, here are 20 tips designed to get clients to pay their bills by the due date or earlier.

- Track mileage, send invoices, connect accounts, do your taxes, and much more—all with Solopreneur.

- If you want to do your own taxes with unlimited expert help as you go, choose TurboTax Live Assisted Premium.

- Talk live to an expert who can give you one-on-one advice as often as you need.

- QuickBooks Solopreneur features easy-to-use tools to help you drive growth and financial stability.

- Whether our experts prepare your tax return or you do it yourself, we guarantee our calculations are always 100% accurate, or we’ll pay any penalties.

Click here to troubleshoot common sign-in issues. Discover how integrated payroll apps can save you and your clients hours of admin. Check out PaySpace for Africa and HReasily for Asia.

Contents:

We help setup Quickbooks for contractors, and then we perform the bookkeeping every month so they have perfect financials. We’ll help keep track of profitability for every project, and we’ll ensure that you’re monthly financial statements are always ready for lenders, auditors or other oversight. Passageway Financial is a family owned CPA, Tax & Accounting Firm based out of Minnesota, that helps contractors around the nation with their bookkeeping, tax reduction planning, payroll and we serve as a CFO.

If you have more than five clients, you’ll need the Plus version, but all of the plan tiers are reasonably priced. For the best experience and to ensure full functionality of this site, please enable JavaScript in your browser. Our high service quality and “raving fan” clients are the result of our commitment to excellence. We constantly strive to educate our team members and our clients through a variety of resources and tools. We continually develop these capabilities by attending trade shows, conferences, and continuing education programs to understand the full picture of what our clients face.

FINANCIAL & BUSINESS MANAGEMENT CONSULTING

All limited company contractors are required to submit an annual confirmation statement to Companies House. This document provides an update on any changes that the business may have undergone and is a requirement for anyone operating as a limited company. There is a one off annual £13 fee that the company Director is required to pay Companies House. We chose QuickBooks because we believe it has the most features, ease-of-use, and pricing that most independent contractors will need. But every contractor is different, so one of the other accounting apps on our list may fit your needs better.

So I want to share some of these local entrepreneurs that are a cut above the rest when it comes to reducing your taxes, serving as an outsourced accountant, and helping with Construction specific problems. Passageway Financial helps small businesses with their accounting, bookkeeping, tax and payroll — and they’re really focused on small businesses, contractors, and home services business. They help businesses with their business tax returns, but deliver pro-active tax reduction services as well.

Accountancy tips and further thoughts

HMRC’s IR35 legislation has been a constant source of irritation and difficulty for limited company contractors ever since its introduction back in the year 2000. Ever since then IR35 has adapted and evolved to the growing temporary workforce and contractors have been affected more and more by the legislation as the years have gone on. We charge an hourly rate to evaluate your books and fix the problems we find.

Back to Basics: Vehicle Fleet Safety — EHS Daily Advisor — EHS Daily Advisor

Back to Basics: Vehicle Fleet Safety — EHS Daily Advisor.

Posted: Mon, 24 Apr 2023 09:17:23 GMT [source]

Our team of highly qualified financial advisors works diligently to address our clients’ issues and always produces timely effective responses you can rely on. We are accustomed to working under pressure and responding quickly with accurate solutions, no matter how challenging the task may be. We provide complete services that fit the requirements and guidelines of your personal and business needs. We also ensure that your financial and tax records are maintained according to the Canada Revenue Agency regulations.

Whether you need help deciding what kind of entity to launch or would like assistance with back paperwork, tax shield planning or growing your business, call SLC Bookkeeping. For a fraction of the cost of a full-time employee, SLC provides you part-time, outsourced bookkeeping with a full-time presence. Our team of dedicated accountants have the knowledge and know-how essential in helping you operate successfully as a limited company contractor. We don’t expert our customers to be accountancy boffins, but we certainly expect our accountants to be!

© 2022 Brown Edwards & Company, L.L.P. Certified Public Accountants Privacy Policy | Terms of Use | Client Portal

We reviewed accounting apps on a variety of platforms, for mobile devices and desktop computers alike, so you can assess which features meet your needs as an independent contractor. Working as a contractor means that you are constantly here there and everywhere, so you don’t always have time to sit with your accountant and go through all the information they need. The nature of the industry also means that you don’t have the time to sit down and go through your own accounts, so you require a system that is easily updateable on the move. Whether you have a Fixed Price, Cost Plus or Time and Material contract, we have the expertise you need to manage and report on financial data so you remain compliant with contract standards. This is the cost of doing business with the world’s number one consumer. Companies that do not prepare for and then comply with these requirements, will not be viewed as suppliers of value to the government and will not be doing continuing business with the Government.

He specializes in writing about cryptocurrencies, investing and banking among other personal finance topics. With nothing to download or install the software can be easily accessed online, so wherever you are in the world you will be able to access your accounts easily. Most importantly, at Leon Jaferian, CPA, Inc. we strive to build a lasting relationship with each of our clients.

Accounts Junction is a popular accounting service providing the agency with clients all over the world. Don’t let bookkeeping and accounting be another source of stress and frustration for you. Contact Profit Matters today to learn more about our services and how we can help you streamline your financial processes and make informed decisions about your business’s future.

What you need to know about the city controller and the three Philly Democrats running for the office — The Philadelphia Inquirer

What you need to know about the city controller and the three Philly Democrats running for the office.

Posted: Tue, 18 Apr 2023 12:00:00 GMT [source]

With our construction accounting solutions, you can be sure that you will always receive the highest quality services. We are confident that you won’t find more value for money anywhere else. With our budget and forecasting services, you can make better-informed decisions faster. Gain in-depth insights and understand important trends for a small fraction of what hiring a CFO would cost. SLC Bookkeeping can also create a balance sheet, income statement and cash flow statement that prepares your business for lenders and investors. We are renowned as specialists in the contracting industry and are recognised as industry leading contractor accountants.

This website contains detailed expense guides onentertaining,business clothing,personal incidental expenses,company donations,business gifts,trivial benefitsand many other areas. These areas need careful research and thought on to see what you can claim as expenses and save tax. We used to trade under the name Qdos Accounting before we became QAccounting, so if you’ve heard about us under our previous trading name, we’re still the same bunch we always were. It’s important that if you are registered for value added tax that you are submitting your VAT returns on a quarterly basis.

April 2023 issue of the Employer Bulletin — GOV.UK

April 2023 issue of the Employer Bulletin.

Posted: Wed, 19 Apr 2023 08:00:55 GMT [source]

For an existing company, it can be a major paradigm shift for the company as the compliant accounting system for government contracting is sometimes referred to a «Job Cost Accounting System on steroids». Either way, ReliAscent®has been able to help hundreds of companies in both of these categories with successful implementation of such a system. ATS Accounting & Tax Edmonton provides accounting services for a wide range of industries by making use of various major accounting software available in the market today. Our team provides financial reports at regular intervals to keep you informed of expenses and revenues in order to develop forward-looking financial strategies and deal with any unforeseen issues. By doing so, we aim to assist you in evaluating the performance of your business and make the appropriate adjustments to keep your construction company profitable and growing during seasonal cycles.

- The small accounting firms are dedicated to working with smaller groups customers in a more intimate way.

- KatzAbosch provides a wide range of specialized services to government contract accounts.

- Plumbers, electricians, painters, landscapers, writers and real estate agents all work on a freelance or contractual basis to provide a service of some type.

- Our team provides financial reports at regular intervals to keep you informed of expenses and revenues in order to develop forward-looking financial strategies and deal with any unforeseen issues.

- We can assure you that if you do decide to use us for your business, we will provide unparalleled expertise and attention to detail that is second to none.

We are here to help you grow through our expertise and what makes your technology, products, or services special. Accurate, insightful financial reporting helps business owners pursue the most profitable jobs. After assisting a large, local Electrical Contractor in hiring a new President, it was determined that the company needed to do something to stimulate and retain key employees. After consulting with Brown Edwards, we set up a new, incentive based compensation plan for all eligible employees and create “Success Factors” for each employee level for which the incentives would be based. The success Factors were special financial goals or achievements that, when met, triggered a special incentive.

As in life, going for the cheapest option will likely not be the best contractor accountant service. What is more, it is also not always true that the more that you pay, the better IT contractor accounting service you will receive. Therefore, you will need to look into this and do your own research here. We recommend hiring a good contractor accountant specialist who provides the best services. Your accountant should know how UK contractors and freelancers operate and can look after you from the get-go.

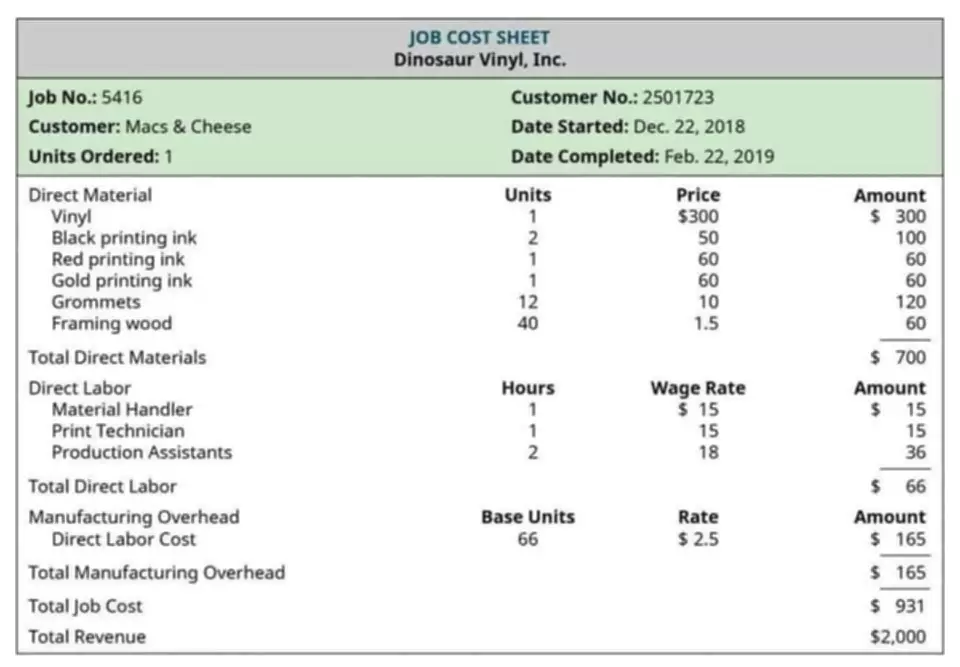

A manufacturer’s product cost is the cost of the product’s materials, labor, and manufacturing overhead. For example, if a widget costs $10 to build, then its price must be higher than $10, or else the business cannot earn a profit on its sale. Another interaction between price and cost is that costs are subtracted from prices to arrive at a firm’s profit, either for individual products or in aggregate for the entire firm. For example, if a company generates $1 million of sales from its established product prices, and it incurs $800,000 of costs, then its profit is $200,000. Though similar in everyday language, cost and price are two different but related terms.

Can we use cost instead of price?

Cost can also be used of prices in general, especially in idiomatic phrases like "the cost of living." You will occasionally see price used this way ("The price of housing has gone up this quarter"), but cost is more common ("The cost of housing has gone up this quarter").

Or maybe you’ve had to take a good look at the cost of living in an expensive city. When we start a new hobby or take a trip, we usually have to evaluate its price as well. TrendingAccounting is a top small business blog that shares information about accounting, bookkeeping, tax, finance, and auditing. Further, it is one of the four P’s of the marketing mix, the other being product, place (distribution) and promotion. If rising prices all around tend to make you anxious, take a deep breath. Better to read about the difference between panic attacks and anxiety attacks than to have one.

Key Differences Between Price, Cost and Value

Every company must determine the price customers will be willing to pay for their product or service, while also being mindful of the cost of bringing that product or service to market. The cost can be labor, capital, staff, selling and distribution, marketing, advertising, etc. On the contrary, the Price can be the maximum retail price of the product or other prices charged by different customers. If we say, “The toy costs $10,” we can all understand this sentence.

- In essence, cost is the expenditure required to create and sell products and services, or acquire assets.

- Price is the consideration given in return for acquiring a good or service.

- Discover what the cost-plus pricing method in a company is and when it is usually used.

- For example, the phrase the total cost is $27 is the same as the total price is $27.

- Now, the medicine bought by the buyer is of utmost importance to him, as it is going to treat his loved ones.

- If you purchase a brand new car, then the amount you pay to the car seller for its acquisition is its Price while the amount invested in manufacturing the car is its Cost.

Best Supply Company sold 10,000 pounds of materials to Mack Manufacturing Co. for $3 per pound. Mack recorded the materials in its Materials Inventory account at its standard cost of $2.80 per pound. The difference between Mack’s actual cost of $3 per pound and Mack’s standard cost per pound of $2.80 times 10,000 pounds is a $2,000 cost variance for Mack. However, accountants refer to this unfavorable cost variance as a materials purchase price variance. Now, cost and price also have distinct meanings in terms of accounting and financial analysis. So in these formal uses, it’s best to be careful with these words.

Related Differences

This usefulness is of the medicine at that point of time is nothing but ‘value’. In this piece of writing, you will get to know the differences between price, cost and value. Harold Averkamp (CPA, MBA) has worked as a university accounting instructor, accountant, and consultant for more than https://kelleysbookkeeping.com/what-is-fixed-asset-management/ 25 years. He is the sole author of all the materials on AccountingCoach.com. «The price of the part was too high, but the mechanic gave me a deal, so the repair costs weren’t too bad.» Maybe you remember the price of your favorite candy bar when you were a kid versus what its price is now.

What is the difference between cost price and selling price?

We know that Cost Price is the amount at which the retailer/seller has bought the product. Selling Price is the amount at which the buyer/customer is willing to purchase that product.

The two opposing forces are always trying to achieve equilibrium, whereby the quantity of goods or services provided matches the market demand and its ability to acquire the goods or service. The concept allows for price adjustments as market conditions change. If you purchase a brand new car, then the amount you pay to the car seller for its acquisition is its Price while the amount invested in manufacturing the car is its Cost. Normally, the price of any goods or services is more than its cost because the price includes the profit.

Head to Head Comparison Between Cost vs Price (Infographics)

Indeed, it is crucial to understand the meaning of every word in order to drive the intended message. The price element differs from the other three elements in the sense that it is the price which generates revenue, while the other three adds to the cost of production. This has been a guide to the top difference What Is The Difference Between Cost And Price? between Cost vs Price Here we also discuss the Cost vs Price key differences with infographics and a comparison table. When cost and price refer to an amount we pay for something, they are virtually interchangeable. For example, the phrase the total cost is $27 is the same as the total price is $27.

How Much A Bottle Of Wine Cost The Year You Were Born — Daily Meal

How Much A Bottle Of Wine Cost The Year You Were Born.

Posted: Sat, 27 May 2023 14:15:00 GMT [source]

All income and expenses of previous periods are closed to the capital or retained earnings account of the business. All firms maintain records and they are called ledgers in accountancy. The entry in the ledger is made under single entry or double entry.

This is called double-entry accounting and it acts as a safeguard that allows a business’s books to balance. Journal entries are the first step in the accounting cycle and are used to record all business transactions and events in the accounting system. As business events occur throughout the accounting period, journal entries are recorded in the general journal to show how the event changed in the accounting equation. For example, when the company spends cash to purchase a new vehicle, the cash account is decreased or credited and the vehicle account is increased or debited. A journal entry records financial transactions that a business engages in throughout the accounting period. These entries are initially used to create ledgers and trial balances.

Expense Journal

No more manually inputting journal entries, thinking twice about categorizing a transaction, or scanning for missing information—someone else will do that all for you. The opening entry can now be recorded in the ledger using the general ledger journal. The opening entry will vary from business to business depending on the contents of its opening balance sheet.

- Your business will need to transfer the balances into the income summary account to close these revenue and expense accounts.

- An opening balance equity can be in a positive-sum or a negative number.

- Opening entry can be either side of a ledger as it depends on the performance of the firm.

- It’s used to prepare financial statements like your income statement, balance sheet, and (depending on what type of accounting you use) cash flow statement.

- Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching.

- Click here for a free trial of the FreshBooks bookkeeping and accounting services now.

AccountEdge Pro is a good fit for small and growing businesses that are looking for an accounting application that can grow along with them. In the expense journal, we record a debit for the amount that went towards interest separately from the amount that reduces the balance. Going through every transaction and making journal entries is a hassle. But with Bench, all of your transaction information is imported into the platform and reviewed by an expert bookkeeper.

Opening Entries for New Business and Running Business

If your business uses automatic software to manage your financial needs, it will not use an income summary account to shift these temporary account balances. A reversing entry makes it easy and convenient to record future transactions and is made at the beginning of the next accounting period. It’s an optional step in the accounting cycle but can facilitate future accounting transactions without making additional journal opening balance journal entry example entries. When making reversing entries, you just have to reverse the adjusting entry you made. With small business accounting software, business owners and bookkeepers rarely have to make journal entries, as good accounting software will make the entry for you after you complete a form. For instance, when you send a customer an invoice, it will record a journal entry to debit Accounts Receivable and credit Sales.

Use your bank statements to make sure the opening balance is correct. Learn how to enter an opening balance after you already created an account to track transactions in QuickBooks. Journal entries may also include other details (such as a reference number), depending on your business and record-keeping needs. Even though opening stock isn’t explicitly listed on the balance sheet, its impact is reflected indirectly. Make your balance sheet look more professional and clean by clearing the balance in this account and bringing it to zero.

Journal Entry for Opening Stock

The journal entry may also include a reference number, such as a check number, along with a brief description of the transaction. Essentially, all opening entries of a new fiscal year are the exact entries and figures of the previous period’s closing entries. Therefore, the beginning balance of these accounts can be taken from the previous period closing account balances. Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping.

The opening balance consists of the assets, capital & liabilities of the company that is being brought from the previous year’s Balance sheet. Check out the official website of Vedantu or download the app for a comprehensive and easy to understand explanation. If you’ve made the choice to use accounting software, financial accounting journal entries become rare, with typical journal entries made only to enter accruals, month-end adjustments, and depreciation expenses. The process of closing entries in accounting ensures the temporary accounts have a balance of zero at the end of the period. The funds must be transferred into another account, the income summary account, to bring each account balance down to zero.

Content

The information offered by bookkeeping is insufficient for making decisions. In contrast, at the very least, accountants often hold a bachelor’s degree in accounting. They could also pursue certifications to broaden their skills and show off their knowledge. Access to your company’s data allows you to make the best decisions. Bookkeeping gives you complete, reliable information about your company, enabling you to make decisions for expansion. According to this method’s general rule, the debit amount must always match the credit amount. The moment the company reaches this point, it is considered balanced.

It can be confusing and overwhelming if you’re diving in for the first time. Your small business already has an accountant, so does it really need a bookkeeper as well? While the terms bookkeeping and accounting are often used interchangeably, the definition of a bookkeeper is different to that of an accountant. Small business booking has to be inclusive of your accounting policies and procedures. Too often customers come in and they have no cadence and no rigor around how they are managing their books. You need to have visibility into the cash needs of the business, not just what is coming into the business and making sure you are paying your vendors on time.

Our products

We provide third-party links as a convenience and for informational purposes only. Intuit does not endorse or approve these products and services, or the opinions of these corporations or organizations or individuals. Intuit accepts no responsibility for the accuracy, https://www.bookstime.com/ legality, or content on these sites. By staying up to date with your bookkeeping throughout the year, you can help alleviate some of the stress that comes with filing your taxes. Let us walk you through everything you need to know about the basics of bookkeeping.

- Expenses refer to purchases made by the business or costs the business incurs.

- Bookkeeping refers to the process of recording financial transactions for a business.

- Accounting looks at bookkeeping to understand patterns and possibilities for moving forward.

- Many or all of the products featured here are from our partners who compensate us.

- Sometimes, bookkeepers also handle payroll and human resources duties.

- Creating a system for submissions and reimbursements helps make sure you don’t miss a transaction and that records stay up-to-date and accurate.

By logging and keeping track of all financial transactions, you will have easy access to any financial information you might need. To make it even easier, bookkeepers often group transactions into categories. As a partial check that the posting process was done correctly, a working document called an unadjusted trial balance is created. Column One contains the names of those accounts in the ledger which have a non-zero balance.

Trial balance

Bookkeepers have been around as far back as 2600 BC—when records were tracked with a stylus on slabs of clay—making bookkeeping not the oldest profession, but pretty darn close. Effective bookkeeping requires an understanding of the firm’s basic accounts. These accounts and their sub-accounts make up the company’s chart of accounts. Assets, liabilities, and equity make up the accounts that compose the company’s balance sheet.

For specific advice applicable to your business, please contact a professional. This page is for informational purposes only and is not intended to be relied upon as legal, financial, or accounting advice. Even your growing company may have thought what is bookkeeping of moving from Quickbooks Online/Xero to Netsuite in order to support your growth. With this, our recommendation has been to pair QBO with NoCode automations to extend your time using Quickbooks and get a better return on your investment.

Income Statement and Bookkeeping: Revenue, Expenses, and Costs

In accrual basis accounting, you’ll record each financial transaction, regardless of whether money changes hands. If you send a customer an invoice, you’ll record the amount, then record the amount that the customer pays you. Modern cash basis accounting is excellent for smaller companies or those who produce products on demand. ECommerce platforms can quickly adapt this method to keep track of their books. Cash basis accounting transactions are recorded only when cash changes hands. For instance, you’ll record income when a customer pays you and when you pay your bills.

Accounting work includes looking at financial data to help suggest ways to help optimize your business tax returns, such as tax preparation and tax filing. Accountants will also have a good grasp of tax deductions that your business can take advantage of. When we talk about selling accounting and bookkeeping services, the two are inseparable. We never feel comfortable actually providing just bookkeeping services without a controller review.

Organizing your expenses into specific budget categories helps you prepare for a smooth tax filing season and make more informed business decisions. Your best bet is to find a local accountant who can take on the tasks you need, who will only charge you hourly for the work you need. As you grow, having a professional, outsourced accountant on your side gives you the advantage of proactivity rather than reactivity. Trained accountants can spot red flags ahead of time and notify you about things like cash flow discrepancies. As the owner, you want to grow your business and focus on the vision of the company itself.

Advantages of Outsourced Bookkeeping

- As the owner, you want to grow your business and focus on the vision of the company itself.

- To elaborate on how it helps organizations, this guide takes a look at what outsourced accounting is and its top benefits.

- However, business process outsourcing can be helpful with a long list of business functions, including HR, marketing, accounts payable (A/P), research and development and sales, among others.

- This allows businesses to reallocate resources to focus on their core operations and strategic initiatives, giving them a competitive advantage.

- Additionally, businesses often underestimate the ongoing costs of BPO providers.

As a company grows, its financial processes and needs expand, necessitating a more advanced system in place. Outsourcing partners assist in scaling the services according to the company’s size, enabling them to focus on their core competencies without being weighed down by administrative tasks. Cloud computing has considerably changed the landscape of accounting and financial data management.

This ensures you’re getting the best support and advice on a range of financial matters, from tax planning to financial forecasting and budgeting. In this article, we’ll explain what exactly outsourced accounting is, what it covers, and how it can help your company. We’ll also give you some key tips and insights into finding a provider and ensuring the process goes smoothly.

Saves time

By comparison, outsourced accounting services typically cost a fraction of these rates and deliver better results. At LBMC, our mission is to support entrepreneurial businesses at every stage to go further. Building a robust accounting infrastructure is a foundational element of that. pcaob rulemaking That’s why our outsourced accounting services are set up to provide firms with the exact level of support they need.

How do you choose a quality outsourcing provider?

Some outsourcing companies hire talent from across the globe (offshoring) or nearby countries (nearshoring). In doing so, public perception may negatively affect an outsourcing business as customers or community members perceive the business is sacrificing domestic jobs. In addition, customers sometimes perceive lower-quality services or products when those services or products are fulfilled via nondomestic talent. Outsourced accounting services have become a more common and practical solution for various businesses today. Be it startups, small to medium-sized businesses, or non-profit organizations, outsourcing offers major advantages.

Many of the concerns that might be swirling in your mind have been addressed. Leave the administrative load with us and get more time to focus on revenue-generating activities. In this guide, we’ll show you the areas you can outsource and help you pick the best experts for the job, so you can get back to doing what you love. So you shouldn’t feel like you have to handle all the finances in your small business. To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website. As alluded to in the previous step, outsourcing isn’t a “set it and forget it” solution.

Wages are often paid via direct deposit and pay stubs are provided to employees. Records are kept, estimated taxes are paid quarterly and taxes are often filed yearly. To learn more about how we can help, speak to one of our friendly experts today — or check out our in-depth payroll processing guide. Outsourcing these tasks to professionals allows you to better manage your cash create an invoice in word flow, maintain healthy relationships with your suppliers, and more accurately gauge profitability. If you’re hiring across borders, you’ll have to recruit in-house accountants in all the countries you’re onboarding in.

These services help businesses improve customer experience and maintain a competitive edge in the market. Many businesses, from small startups to large companies, opt to outsource various processes due to the availability of innovative services in today’s highly competitive and dynamic business environment. It can be difficult to understand the benefits of partnering with an outsourced CFO before starting to work with one. Many times, businesses have all kinds of hidden opportunities hidden in their internal systems and accounts. It’s the job of the CFO to uncover these inefficiencies and implement strategic changes to remedy them.

This can be costly and complex, especially if you don’t have legal entities in those countries. The amount of work you have available may not justify hiring one in-house, even on a part-time basis. That’s why many businesses — from fledgeling startups to multinational enterprises — opt to outsource instead.

Common Benefits of Business Process Outsourcing

Offshore outsourcing is a company that’s in another country, and nearshore outsourcing is a company that’s in a country not too far from your own. BPO also offers companies the benefits of quick and accurate reporting, improved productivity, and the ability to swiftly reassign its resources when necessary. BPO is often called information technology-enabled services (ITES) because it relies on technology and infrastructure that enables external companies to perform their roles efficiently. The global business process outsourcing market was valued at $281 billion in 2023 and is projected to grow at a compounded annual growth rate of 9.6% from 202 to 2030. How finance leaders use AI for improvements in process more detailed update quality, cost, and efficiency. Using AI-powered digital assistants, we’re already transforming and augmenting essential finance workstreams such as source-to-pay, order-to-cash and record-to-report.

Those who become a CPA must endure rigorous testing of accounting and business concepts, taxes and regulations, and financial reporting standards. The exam consists of four parts, and candidates must pass all four within an 18 to 30-month period, depending on their state. The investment in time and resources for CPA exam preparation is significant, including exam fees, review courses, and the potential need for additional coursework to meet the 150-hour requirement. An accountant without a CPA license is proficient in overseeing financial records and conducting financial analysis. These professionals can execute a wide array of accounting duties, including the meticulous recording of financial transactions and the effective management of financial data.

- Although the terms may sometimes be used interchangeably, a CPA and an accountant aren’t quite the same.

- While a professional accountant will assist you with bookkeeping and payment management, a CPA will assist you with your business’ growth, as well.

- CPAs will need to pass a licensing exam in the state in which they intend to practice, as well as meet any other criteria their state may require.

- Someone with complicated finances will often benefit from advance tax planning, whether they’re setting up a trust or maximizing deductions.

- Bureau of Labor Statistics, there were 1.4 million accountants and auditors working in the United States as of May 2018.

Her work has appeared in Business Insider, Forbes, and The New York Times, and on LendingTree, Credit Karma, and Discover, among others. Considering the average length of time it takes to achieve the required degree and work experience, it takes, on average, seven years to achieve the CPA certification if starting from scratch. Usually, the CPA certification exam is the last step in the process of receiving a CPA certification. However, a handful of states, like Alabama, allow a candidate to find and obtain the necessary work experience after completing the exam.

What is public accounting?

Reporting options are limited to financial statements and a couple of list reports, with few customization options available, though reports can be exported to Microsoft Excel if customization is desired. Xero is an easy-to-use online accounting application designed for small businesses. Xero offers a long list of features including invoicing, expense management, inventory management, and bill payment. Learn how to produce and analyze financial statements, payroll accounting functions, and more in the Intuit Bookkeeping Professional Certificate. As you fulfill the CPA requirements, it’s wise to keep your job search materials updated, including your resume and LinkedIn profile.

These programs introduce you to financial accounting, auditing, and taxation topics at both the individual and corporate levels. They also give you an opportunity to gain experience using industry-standard computer applications and software. Their duties may include organizing and recording financial transactions, reconciling accounts each month or annually, analyzing financial statements and preparing budgets. Accountants are often responsible for ensuring that bank payments are made on time, preparing tax returns and managing balance sheets. Accountants are often responsible for evaluating a business’ overall financial operations and providing guidance to help the business make well-informed financial decisions. Some employers may also only consider applicants who have gone on to earn their master’s degree in accounting.

History of the CPA Designation

The amount of CPE you must complete will vary based on the state in which you are licensed. Pursuing a CPA license can be worth it for those who want to work in public accounting, as it can lead to better job opportunities and higher salaries. Accountants are legally allowed to prepare tax returns, although they may not have as much knowledge of tax codes as a CPA does. Another important distinction is that CPAs can represent clients in front of the IRS in the event of a tax audit, and they can sign tax returns, whereas non-CPA accountants cannot. CPAs with less than one year of experience earn $70,000 annually, while those with more than 20 years of experience earn $150,000. In fact, according to the Bureau of Labor Statistics, CPAs earn 10% to 25% more than non-certified accountants.

CPAs are essentially licensed accountants who offer assistance to companies and businesses in the areas of expense and investment management, as well as financial planning. Additionally, they are able to provide more advanced taxation and auditing services than unlicensed accountants. CPAs are in demand in larger global ventures like the Big Four, MNCs, and the public sector, making it a one-stop license for a myriad of opportunities. Accountants typically have a bachelor’s degree in accounting, finance, or a related field.

CPA vs. Accountant: What Are the Main Differences?

This three-day exam allows you to demonstrate your competency in the skills needed to become a chartered professional accountant. While public accountants serve multiple clients at any given time, private accountants perform accounting services within an organization’s internal finance department. You can also pursue management consulting, information technology, education, and financial planning careers. While these may not seem like typical professions for accountants, many industries rely on financial expertise. Like most accountants, CPAs perform a wide range of accounting, auditing, tax, and consulting work for corporations, small businesses, non-profit organizations, governments, and individuals. CPA is a license awarded by the state you want to work in, which allows you to practice as an advanced accountant.

A Certified Public Accountant (CPA) is an accountant who has met state licensing requirements. Although requirements vary by state, they typically include minimum education (usually a bachelor’s degree in accounting) and experience requirements, plus passing the CPA exam. CPAs may have all of those same duties and responsibilities of an accountant, but their extra qualifications mean they are eligible to have additional duties. CPAs are capable of preparing audited financial statements filed with the Securities and Exchange Commission. They can perform external audits or audit public companies, and a CPA is also qualified to represent taxpayers and companies during an audit, defending a return for the client. Nevertheless, despite some similarities, these positions have distinct functions and many unique responsibilities.

Larger organizations might benefit from having an internal accountant or bookkeeper on staff. This person would generally handle all the accounting work, including bookkeeping, payroll and tax filings; offering business leaders strategy sessions to make a strong financial impact. cpa vs accountant Therefore, you can take on additional duties related to the Internal Revenue Service (IRS) and Securities and Exchange Commission (SEC) that not all accountants can perform. Some CPAs specialize in areas like forensic accounting, personal financial planning, and taxation.

It’s a designation that allows accountants to work in the field of public accounting. A CPA license isn’t required to work in corporate accounting or for private companies. However, public accountants—individuals working for firms such as Deloitte or Ernst & Young that provide accounting and tax-related services to businesses—must hold CPA designations. Whether you pursue a career as an accountant or decide to earn a CPA designation will depend on your career goals and the type of work that you ultimately want to do.

That will reduce accounts payable, which is also a negative adjustment to FCF. A common approach is to use the stability of FCF trends as a measure of risk. If the trend of FCF is stable over the last four to five years, then bullish trends in cash flow from assets equation the stock are less likely to be disrupted in the future. However, falling FCF trends, especially FCF trends that are very different compared with earnings and sales trends, indicate a higher likelihood of negative price performance in the future.

Calculated Using the Direct Cash Flow Method

In that case, we wouldn’t truly know what we had to work with—and we’d run the risk of overspending, budgeting incorrectly, or misrepresenting our liquidity to loan officers or business partners. Our intuitive software automates the busywork with powerful tools and features designed to help you simplify your financial management and make informed business decisions. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses.

Free Cash Flow (FCF): Formula to Calculate and Interpret It

Ways to optimize your operations can include improving supply chain management, reducing downtime in production, and implementing lean manufacturing practices. Your job as an analyst is to connect the numbers to the real-world factors driving the business. Calculating the change in assets is an effective first step in doing just that.

Reveals Outcomes of Past Financial Strategies and Decisions

- While depreciation is an expense that reduces a company’s net income, it doesn’t represent an actual cash outflow.

- Remember the four rules for converting information from an income statement to a cash flow statement?

- Equity issuance is capital obtained by a company by issuing new shares of stock.

- You use information from your income statement and your balance sheet to create your cash flow statement.

- To find your NWC, you’ll need the Balance Sheets from two consecutive periods (a period can either be a fiscal quarter or a year).

The Motley Fool reaches millions of people every month through our premium investing solutions, free guidance and market analysis on Fool.com, top-rated podcasts, and non-profit The Motley Fool Foundation. It’s easy to see how using unearned revenue with annual subscriptions can give the business the wrong idea about their cash flow. Their bottom line looks great, but it may not be the best representation of how cash is actually entering the business. Every month, they move $100 from their unearned income to their sales revenue.

Twenty-nine percent of small businesses fail because they run out of money. To avoid this, you need to know how to calculate cash flow for your company before it gets too late. Luckily, there are different cash flow formulas to help small businesses monitor how money moves in and out as they go about their day-to-day operations. Free cash flow is the money left over after a company pays for its operating expenses and any capital expenditures. normal balance Free cash flow is considered an important measure of a company’s profitability and financial health. As for the balance sheet, the net cash flow reported on the CFS should equal the net change in the various line items reported on the balance sheet.

Great! The Financial Professional Will Get Back To You Soon.

There are multiple cash flow formulas, each best suited for specific purposes. How can you, as a business owner and key stakeholder, prepare to tackle these challenges? This blog will discuss the significance of calculating cash flow and provide practical examples to guide you in calculating net cash flow effectively.

Net Cash Flow Formula

The completed statement of cash flows, which we’ll work towards computing throughout our modeling exercise, can be found below. Under the indirect method, the format of the cash flow statement (CFS) comprises of three distinct sections. The cash flow statement presents a good overview of the company’s spending because it captures all the cash that comes in and goes out. This is another example of a cash flow statement of Nike, Inc. using the indirect method for the fiscal year ending May 31, 2021. Analysts look in this section to see if there are any changes in capital expenditures (CapEx).

- It takes all cash inflows and outflows into account, regardless of the source.

- However, cash flow alone can sometimes provide a deceptive picture of a company’s financial health, so it is often used in conjunction with other data.

- A positive CFFA suggests that a company generates adequate cash to meet its immediate obligations, reducing its dependence on external funding.

- With the assets and liabilities side of the balance sheet complete, all that remains is the shareholders’ equity side.

- Changes in cash from financing are cash-in when capital is raised and cash-out when dividends are paid.

- It also helps investors and creditors assess the financial health of the company.

Cash flow statements are also required by certain financial reporting standards. Bench simplifies your small business accounting by combining intuitive software that automates the busywork with real, professional human support. Add your net income and depreciation, then subtract your capital expenditure and change in working capital. Cash flow statements have been required by the Financial Accounting Standards Board (FASB) since 1987.